We use cookies to ensure that we give you the best experience on our website. If you continue without changing your settings, we will assume that you are happy to receive all cookies on the Business Car website. However, if you would like to, you can change your cookies at any time

The start point for the best source of fleet information |

Now and next: fleets, company car drivers and plug-in vehicles

Date: 01 November 2019

It is widely acknowledged that plug-in cars - be they battery-electric or hybrids - represent a clean and sustainable future for companies and drivers in the UK.

Fleets and company car drivers have been among the most eager adopters of such vehicles to date and many already benefit from the lower running costs and the environmental cache of operating them.

The switch from petrol or diesel cars to alternative fuels is rarely straightforward, though, and fleet operators and company car drivers frequently face obstacles on the road to plug-in vehicle adoption, which is why E.ON and Business Car sought to air the views of those tackling such issues.

We conducted an online survey of fleet decision makers and company car drivers in August 2019, seeking feedback from those who either had direct experience of operating

plug-in vehicles or were seriously considering adopting them.

Respondents from 21 different industries told us not only of the issues they have grappled with but also of their requirements with regards to successfully running plug-in vehicles to best illustrate the current situation for corporate uptake of ultra-low emission vehicles (ULEVs).

In brief, the results prove that fleet operators and drivers alike are incredibly willing to adopt plug-in models, both from an environmental perspective and to take advantage of their lower running costs, although a reliance on petrol and diesel still exists.

They also shine a light on the problematic logistical elements, such as charging and range. The number of vehicles and their function has an impact on a fleet's ability to take on EVs and there is an ongoing dependence on conventional fuels, which is unlikely to wane any time soon.

Fleet fuel types: today and tomorrow

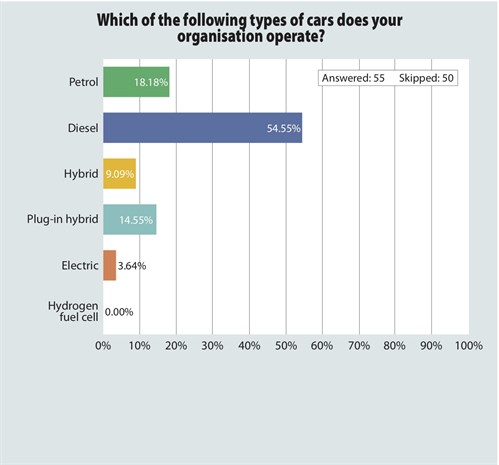

Respondents to Business Car and E.ON's survey were asked to disclose which types of cars their organisations currently operate with respect to fuel type.

Diesel remains the dominant choice among fleets at 54.55%, which is unlikely to come as a surprise to anyone in the business of fleet operation; even though diesel car sales have been in long-term decline - they fell by 29.6% in 2018 alone, according to the Society of Manufacturers and Traders (SMMT) - they remain a common choice for company car drivers, especially those tackling large mileages.

Equally predictable is petrol's second place with 18.18%, but it has a relatively narrow lead over third-placed plug-in hybrids, which came in third and were operated by 14.55% of respondents. Their advantageous tax position for both businesses and drivers has clearly rendered them a popular choice in the sector.

Non-plug-in hybrids - cars such as the Toyota Prius - represented the fourth largest fuel type with 9.09%, while pure electric cars were a small fraction at 3.64%. Respondents were also asked if hydrogen fuel cell cars played any part in their fleet, but the scarcity, high cost and lack of a widespread infrastructure has yet to see them make an impact.

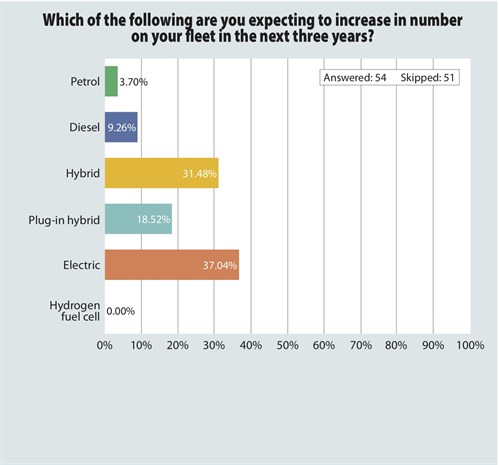

With the exception of hydrogen, fleets' expectations for future fuel types represent a complete contrast to the picture today. Those surveyed believed that alternative fuel cars would account for a much greater portion of their future vehicle parcs, with electric tipped to be the biggest of all, as 37.04% predicted an increase on their fleets within three years. Hybrids were anticipated to be the second-largest growth area, with 31.48% forecasting a rise.

Worth noting is the third-place status of plug-in hybrids among the alternative fuels tipped to account for a bigger slice of fleets. At 18.52%, operators clearly consider them worthwhile, but less so than pure electric and hybrid alternatives.

This is likely due to a combination of strong new products - some of the very latest battery-electric cars are capable of up to and beyond 300 miles on a single charge - and well-documented issues with drivers failing to regularly charge plug-in hybrids, leading to high fuel costs for the business.

A smaller proportion of fleets are nonetheless expecting a rise in petrol and diesel cars in the next three years. The former is the lowest at 3.70%, while 9.26% anticipate more of the latter, which proves that businesses have not yet ruled out conventional fuel types.

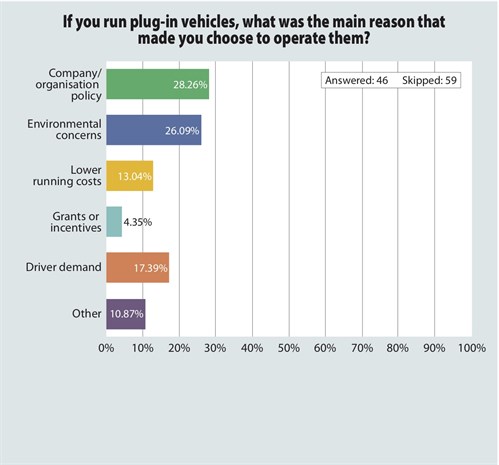

Fleets which have already adopted plug-in cars have a mixture of motivations for making the leap. The most common were cited as company policy at 28.96% and environmental concerns at 26.09%. Employees themselves are clearly keen to make the switch to electric, as demand from drivers was the third-largest reason that caused businesses to begin using plug-in cars, at 17.39%.

Much is made of the lower running costs associated with plug-in cars, but this was relatively far down the list of reasons in fourth place and with 13.04%. While it is clearly an incentive for cost-conscious fleets, the will of companies and employees to adopt EVs is collectively a much greater motive for running them.

The same can be said of grants, which were cited as a reason for running plug-in cars by just 4.35% of respondents. This is likely to be a result of the Government's reduction of the plug-in car grant in November 2018, which saw the discount for battery- electric vehicles fall from £4,500 to £3,500 and subsidies completely removed for plug-in hybrids.

The turning point - Shahid Rana, Strategic Development Manager, E.ON Drive

I'm not surprised that diesel is currently the dominant fuel type for fleets, while hybrids and plug-in hybrids have been gaining in popularity due to their tax advantages.

However, I think we will realistically start to see a lot more operators adopting battery-electric cars very soon, because the Government's decision to remove benefit in kind for those vehicles from April 2020 is particularly attractive for company car drivers, while SMMT sales figures showed a 377.5% spike in sales of battery-electric cars in August 2019 - the first full calendar month after the announcement.

That's supported by the answers to question nine of our survey, which show that fleets expect an increase in electric more than any other fuel type within the next three years. We are already seeing many organisations changing their company car policy to open up hybrids and pure EVs to their lists.

However, tax clearly is not the only motivating factor, as there is a general aspiration among business to lower their emissions - either they just want to do the right thing or corporate social responsibility and public image benefits make it worthwhile. There's also pressure from other areas, such as the impending rollout of clean-air zones across many of the UK's cities, which represents both financial and logistical challenges.

As for fleets that are already operating plug-in cars, there is plenty of evidence that it is often cheaper to go electric in the long run, and those companies that have made the switch are already benefitting from lower running costs.

Charging and the practicalities of plug-in cars

It is well documented that fleets and company car drivers or, indeed, any individual looking to make the switch, have been deterred from operating plug-in cars due to the obstacles associated with running them, as they represent a change in attitude and behaviour compared to conventional petrol and diesel models.

Fleets that have already taken the plunge shared the biggest issues they have experienced while operating EVs, while those considering the move pointed out their most serious concerns about making the jump.

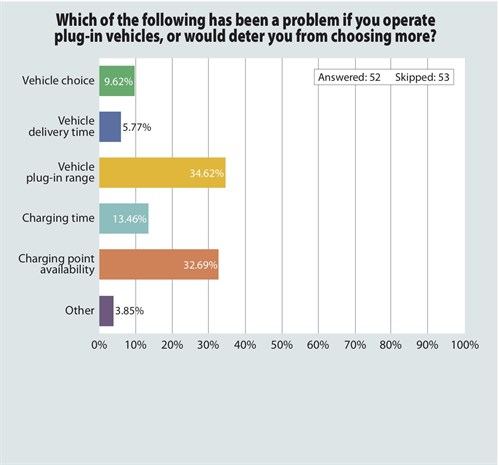

Vehicle range (how far the car can travel on a single charge) and charging point availability were by far the largest causes for concern among respondents, both accounting for around a third of answers at 34.62% and 32.69% respectively. These are not new worries for plug-in car operators, especially battery-electric models.

Businesses clearly fear the idea of stranded drivers lacking the ability to top up the battery, while the restriction on how far the car is able to travel also represents a stumbling block for many.

Charging time was the third biggest burden according to 13.46% of fleets, followed by what some considered the limited choice of plug-in vehicles at 9.62% and long vehicle delivery times at 5.77%.

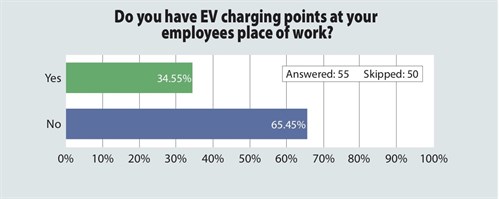

Our survey revealed that electric vehicle charging points are still relatively scarce within business premises.

Only around a third of respondents - 34.55% - said they had charging facilities at their place of work, rendering the remaining 65.45% a comfortable majority.

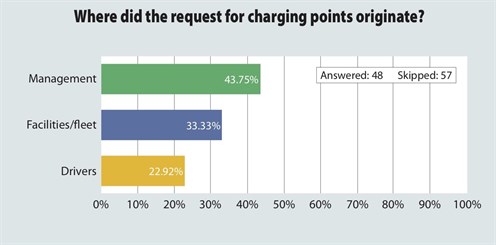

Of those that already have charging points, fleets reported that senior staff prompted the installation, as 43.75% said the original request for charging points came from management. However, fleets/ facilities and drivers are vocal in their calls for workplace charging facilities; separately, they accounted for 33.33% and 22.92% of original requests, but that represents a collective 56.25% - 12.5% more than management alone - which proves that fleet operators and company car drivers represent a strong combined force in the bid for better charging facilities.

As for the supply and fitment of the apparatus itself, the number of businesses that invite suppliers to tender for installations is surprisingly low. A mere 12.24% of respondents with workplace charging points said that their company conducted a tender prior to installing the equipment, while the vast majority, 87.76%, did not.

This suggests that many companies could improve their approach to charging hardware. Those that employ the tender method would typically be presented with a number of different options at varying price points, allowing them to select the most appropriate and cost-effective solution.

Many charging point providers offer complimentary initial site inspections to thoroughly assess the practicalities and logistics of installing the equipment, which would no doubt be offered as part of the tender process or prior to it.

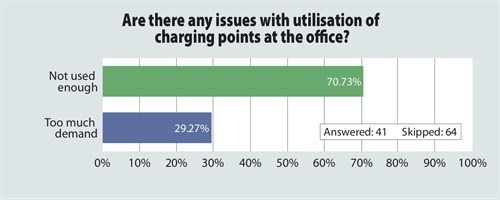

Utilisation of charging points is also an issue for fleets. The majority of those with existing workplace facilities reported that under-use of charging points is a far bigger problem than lack of access due to demand; 70.73% of respondents with charging points at their business premises said theirs were not used enough, while 29.27% claimed to have experienced problems with overly-high demand.

It is interesting to note the correlation between workplace charging point utilisation and the problems fleets have cited as deterrents. Respondents told us that charging point availability was the second-biggest issue in this respect and although this includes the public network and home chargers, many businesses that have already installed charging points are clearly facing the opposite issue.

Access to chargers is a common concern for anyone moving to adopt electric vehicles and, as close to a third of respondents to this question stated, it can be an issue for company car drivers in the workplace.

However, a supplementary issue is the need for businesses to justify the cost and administration of installing charging points at their premises, which can be difficult if the equipment often goes unused.

Leading the charge - Simon Harris, Editor, Business Car

Fleet operators are right to be concerned about switching to plug-in vehicles and those that have already done so have clearly faced their fair share of hitches.

The good news is that more or less all of the problems cited by fleets with regard to adopting plug-in cars - range, charging points, charging times, vehicle lead times and choice - are improving.

We already have battery-electric cars with ranges in excess of 300 miles, the selection of which is only set to broaden in the next decade, while the UK's charging network, including fast chargers, is now said to exceed the number of petrol stations on a per- unit basis.

Businesses that get charging right are the ones that engineer the maximum amount of opportunities for drivers to top up their vehicles. That means installing chargers on their premises - some heavy-duty users have even gone as far as developing their local grid - making them as available as possible and encouraging drivers to use them frequently - company forums or intranets, for example, are often a good way of boosting

awareness.

Home and public charging are also essential, particularly for company car drivers who are less likely to stick to a set route than, say, a utilitarian fleet of electric vans. Assisting drivers with establishing home charge points and equipping them to use public facilities is clearly the way forward.

Company car drivers and plug-in vehicles

In addition to fleet operators, E.ON and Business Car's survey also quizzed company car drivers about their thoughts and aspirations regarding plug- in vehicles.

We have already seen that the demand is there from drivers keen to switch, with appetites growing ever stronger.

The majority of drivers surveyed expect their next car to be powered by some form of alternative fuel and there is a variety of incentives luring them away from petrol and diesel, although concerns linger about the practicalities of living with an EV every day.

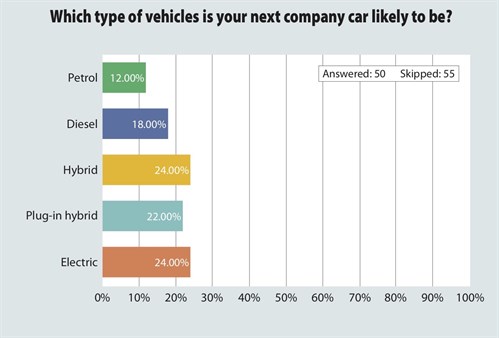

When asked what they expect their next company car to be, the overwhelming majority of company car drivers predicted electric, hybrid or plug-in hybrid.

Hybrid and electric were equally popular at 24%, while plug-in hybrid was a close third at 22%. A portion of drivers still believes there is a future for conventional fuel types, as 18% anticipated that their next car would be diesel and 12% expect a petrol.

However, the three electrified powertrains collectively dwarfed the two internal combustion options in this question, as a combined 70% of company car drivers favoured the former.

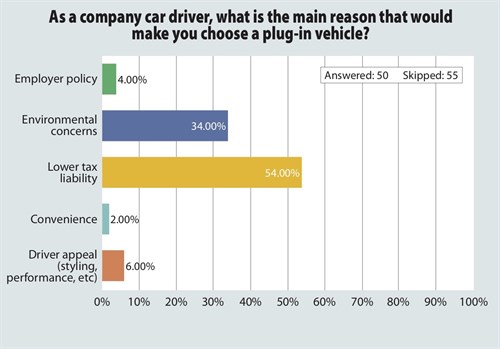

There are two main reasons that company car drivers choose plug-in vehicles: the prospect of a lower tax bill and environmental consciousness.

Lower tax liability was cited as the main reason by 54% of respondents, while 34% said environmental concerns were their biggest motive for going electric.

This is particularly pertinent in the wake of the Government's announcement in July 2019 that it would remove benefit-in-kind tax entirely for zero- emission vehicles from April 2020. The popularity of plug-in hybrids in the corporate sector can also be explained by their favourable tax position for drivers and businesses alike.

Though they account for relatively little in comparison to the two aforementioned incentives, 6% of respondents said that driver appeal - elements such as performance and styling - drew them to plug-in vehicles, while 4% pointed to employer policy and 2% to convenience.

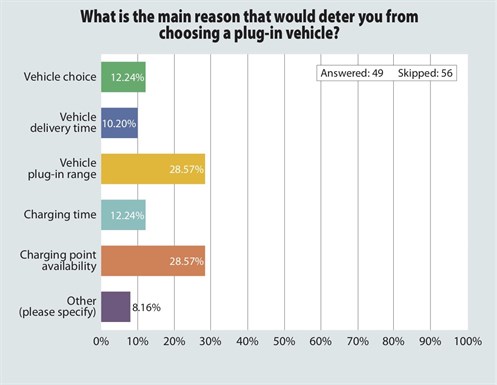

Drivers were also asked to reveal the factors that would discourage them from choosing a plug-in vehicle as a company car, and the results were extraordinarily similar to those for fleet operators.

Vehicle range and charging point availability were once again the primary concerns with equal scores of 28.57%, followed by charging time and vehicle choice, again both at 12.24%, and vehicle delivery time at 10.2%.

The 8.16% of drivers who said they had a different cause for concern about switching to plug-in cars elaborated on their responses.

Cost came up more than once, which suggests that the current company car tax system, in which even zero-emission cars are subject to benefit in kind, along with the vehicle's P11D, which is a factor in the calculation, have been prohibitive for drivers looking to go electric.

One respondent said they had owned a plug-in hybrid but returned it due to reliability issues and another suggested that they did not yet feel that they understood plug-in vehicles and preferred conventional fuel types.

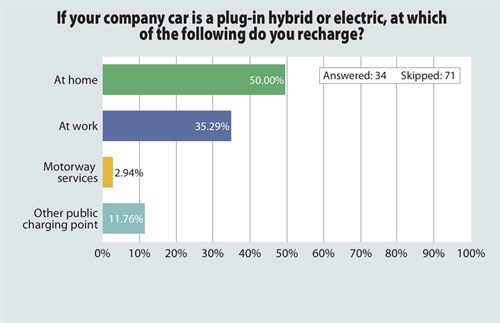

Company car drivers who are already running a plug-in vehicle were asked to reveal their charging habits. The majority top up their cars' batteries at home, as precisely 50% of respondents said they favoured domestic charging, while the workplace was the second most popular venue, as around a third of drivers - 35.29% - said they made use of their organisation's charging facilities.

By contrast, public charging in any form accounts for a nominal amount by company car drivers, as 11.76% said they used facilities outside of the motorway network and a mere 2.94% frequented charge points at motorway service stations.

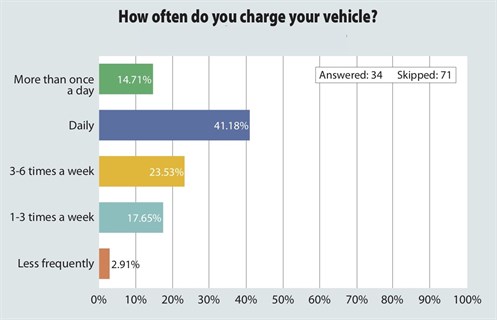

Charging is a daily occurrence for the majority of company car drivers running a plug-in vehicle, as 41.18% said that they charge their vehicles every day. Individual approaches to charging are polarised, though, as many drivers charge their vehicles less frequently. Three-to-six times a week is the second most common period, as reported by 23.53% of drivers, followed by one-to-three times a week at 17.65%.

In fact, the latter two categories collectively match the 41.18% of drivers who charge daily, so there are clearly plenty of company car drivers for whom range anxiety is not a prime concern.

Our figures also suggest that a portion of company car drivers are covering a sufficiently low mileage for plug-in vehicles to meet their needs without particularly regular charging, while a minute 2.94% said they charged their vehicles even less frequently.

However, some drivers still charge more than once a day, as 14.71% of respondents claimed, which suggests that at least a portion requires very regular access to charging points in multiple locations.

Supply and demand - Shahid Rana, Business Development Manager, E.ON Drive

Company car drivers are clearly keen to get behind the wheel of plug-in vehicles and that's going to increase the pressure on manufacturers to produce a greater number of such models.

Supply is one of the biggest issues surrounding electric cars at the moment, especially for some of the newest models with the longest ranges, and fleets are facing very long lead times.

However, there are plenty of established plug-in cars available today and drivers don't have to wait an age to get hold of them. If they're suitable for the individual and for the business, then there's no reason not to put in an order when the driver's existing contract comes to an end, while introducing tried and tested electric models onto a fleet is a great way to get the ball rolling in more ways than one.

Beyond the obvious first step into a plug-in vehicle, initiating a typical three-year lease in the near future will tee up drivers perfectly for the explosion of new electric cars anticipated to hit the market in the early part of the next decade.

That will then leave them poised and ready to stick with electric as it moves further and further towards the mainstream.