Rewind 15 years and if we had asked insurance companies whether telematics data would be used within their market the answer would probably be absolutely not.

Fast forward to today and telematics continues to dramatically reshape the insurance sector and it is clear that commercial fleet managers no longer view telematics as a ‘big brother’ technology, instead shopping for insurance with telematics capabilities with an eye to cutting their premiums and minimising accidents involving at-risk drivers.

A player in this field is Insure Telematics Solutions, or ITS, which has its roots in the insurance space, but has evolved into a telematics product, with its platform proving beneficial to fleets looking to manage their telematics data in a useful and meaningful way.

Meeting with Adam Gooch, commercial director of ITS, over coffee in central London, he explains why the company – which has been running for just over four years – is different from anything else out there on offer to fleets.

“Insurance was an area the whole team had over 15 years of expertise in, as a lot of our senior managers, myself included, came from insurance backgrounds,” he tells us.

From his insurance industry background, Gooch says his skills were quite easily transferred to the telematics company he now works for.

“What I knew extremely well was insurance and what I didn’t know really well was telematics, but once you start to know how it works and the data it produces, and how it can impact different areas of insurance, you realise insurance and telematics completely complement each other.”

What the company in its infancy recognised was that many telematics businesses had entered the insurance space and were trying to apply fleet telematics to insurance, which, says Gooch, isn’t easy.

“Our product is designed for insurance professionals, and across the team we have finance directors, claims and fraud directors, claims handlers, and that real hands-on practical experience of working in insurance and blending it with telematics to suit the market,” he explains.

Despite ITS’s core business being insurance, Gooch tells us how that can be easily applied to benefit fleets.

“Our products and five core capabilities that we have recognise and identify that there were some benefits there in what we are doing and what the fleet market is currently doing,” he says. “Everyone has different requirements from a fleet perspective, but fleets are moving more towards being more hands on and trying to control their fleet better from an economical perspective.”

With this in mind, ITS then had to come up with products for the industry that would save them time and, ultimately, money on their insurance premiums.

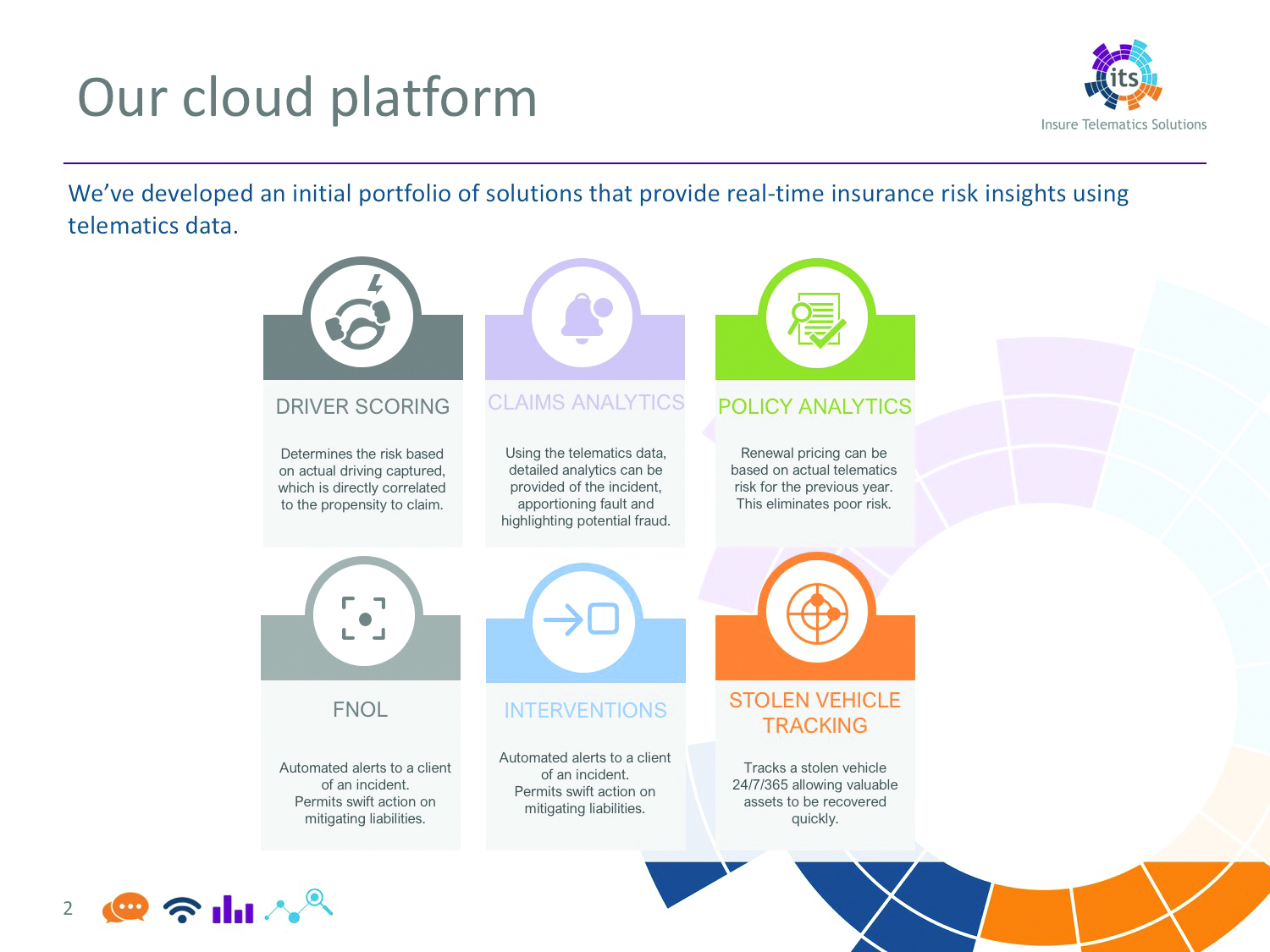

“We needed to make sure we had the exact right product to fit the market, and came up with an end-to-end telematics solution and agnostic device management platform called ITS Hub, which can manage telematics data including first notification of loss, claims management, driver intervention, validation, fraud and risk management and driver scoring,” says Gooch.

The hub is an agnostic device, so can collect data from telematics hardware already installed in fleet cars and gather it to provide fleet managers with useful insights.

The hub has five core capabilities, most of which are able to analyse and report on data to change the way fleet operators manage it, which can be tailored to offer a bespoke solution to meet their needs.

One of the capabilities of the hub is what is known as first notification of loss, or FNOL. In the event that the device in the vehicle detects that a g-force threshold has been breached, its AI-led crash algorithm will analyse the data in real time and judge whether it believes a true accident has taken place.

“In the event that it has it will send an accident notification to the insurer or broker, or whoever our customer is, and that gives them a great customer experience opportunity, as when the driver is in a situation where they need help the insurer will be there to provide it,” Gooch explains. “Then they also have the opportunity to make a huge cost saving by ensuring you take the car to one of their networked garages, and at the end of the day if the insurance company is saving money in this way then it will show in premiums.”

ITS Hub is also able to reconstruct the accident for its insurer partners in the area of

claims management.

“For claims handlers it provides them with actionable insight using Google imagery and Street View, for example, to piece together where the accident happened, who was at fault, and ensure the liability is on the right party, and this also helps the insurer mitigate claims costs,” says Gooch.

Fraud is a particular area where ITS Hub can benefit the industry.

“Policy fraud is a huge issue and costs insurance companies huge bills per year, and telematics can help eradicate that fraud,” Gooch explains.

A practical example of that, explains Gooch, is if you take out a policy saying you live in Peterborough but you actually live in central London and that is where the car is being stored seven nights of the week.

“The telematics data can analyse that the vehicle is being kept in central London and as the insurer you have an opportunity to do something about that and have a conversation with the driver about how to handle that policy from thereon in,” he explains.

The hub can aid fleet operators in particular by providing scoring around what kind of risk the drivers ultimately present.

“It looks at driving behaviours and gives the insurer broker an insight and price that is appropriate, but for the fleet it is a real safety benefit,” explains Gooch.

“Maybe a driver doesn’t drive too well and is driving around erratically and has had a few bumps. As the employer or fleet manager it is your obligation to keep that driver safe as he is in one of your vehicles, and you don’t know that he is unless you are able to see that telematics data,” Gooch explains.

It then enables driver intervention and can flag information to the fleet manager and insurer.

“Speeding is probably the core area here,” says Gooch. “Are you driving the vehicle in a way that is unacceptable to your fleet manager? It is really not about being big brother anymore; it’s not even about curfews. The trend of the market now is more about engagement with the driver, and proving that such engagement delivers and increases performance.”

A specific way in which the hub is able to help fleet managers or people responsible for fleet management in a company is through making the data simple and accessible.

“Our services become more relevant if someone who is managing fleet is not so technically minded or just super busy,” says Gooch. “The hub is a source of data and can take data in from different sources, and we will take it all in in its binary form and then normalise it all and push it out in a common data format through our platform.”

Ultimately, the company has been working hard on simplifying telematics because, “it really doesn’t have to be as difficult as people think.” Gooch adds. “It is about being as efficient as you possibly can so we provide the information to fleets in an easy-to-digest format so they don’t need lots of people or expertise to understand it.”

Due to ITS Hub being agnostic and not requiring fleets to adopt any other hardware, Gooch says this is where the company sees the future going with connected cars.

“We can say to fleets, right, you have a fleet of 1,000 vehicles with hardware in every one of them, we can take data from there and you don’t have to replace those units,” he explains. “All you need to do is facilitate the data coming into our hub. A the end of the day, cars are far more connected now than they ever were and there is so much data coming out of it. Who knows, in five to 10 years’ time the vehicle itself will more than likely be the telematics device, ultimately, so we are saying in-vehicle hardware won’t be necessary.”

A trend Gooch has noticed is that the benefits of telematics are now far more understood by the insurance and fleet market.

“They are learning what telematics can tell them, what it can do for them and what a good service looks like, whereas if you look back a few years the products being provided were probably under-servicing them,” he says.

As for how the company will develop going forward, Gooch says, as with any technology, one of the challenges the company sees is keeping one step ahead with an innovation that develops so quickly.

He says: “The hub is just one example of our development in the evolution of our business away from more traditional hardware and giving the industry access to a platform which is purely a platform as a service.

“We have spent a good amount of time making a really good product and proved our product to large insurers such as Aviva and Axa, so we have validation in that respect,” he continues. “For us now, it is about growing and widening our footprint within insurance in terms of market share, but also within small and bigger fleets. That is our objective in, say, the next 12 to 18 months.”

Gooch says the firm’s unique proposition to fleets and companies will help with aimed growth.

“In the short term we have aspirations to move into the more true fleet management side of things,” he says. “The telematics market is evolving from insurance into the fleet space and there are loads of opportunities all over the world for our platform. As long as someone, somewhere needs data and wants its findings analysed then we can do that for them – and the amount of data coming from the car is only going one way.”

As for opportunities to expand what the hub can do, Gooch points to the autonomous car.

“Although I think there is going to be a longer burn on this in terms of mass market, that type of data is absolutely what the hub could ingest and facilitate,” he says.

The challenge is being one step ahead when you’re dealing with data and technology.

“Although you could say in fact that we see that advancement of technology as less of a challenge, and more of an opportunity for us to grow and enhance our offering to the market and fleets.”