The start point for the best source of fleet information |

Government announces company car tax rates to April 2023

Date: 09 July 2019 | Author: Sean Keywood

The government has announced company car tax rates to April 2023, following a review into the impact of the new WLTP vehicle testing regime.

With full WLTP figures set to be adopted for vehicle taxation in April 2020, including company car tax, there were fears increased bills could be incurred, with official CO2 emissions figures expected to increase under the new testing regime, placing cars in higher tax bands.

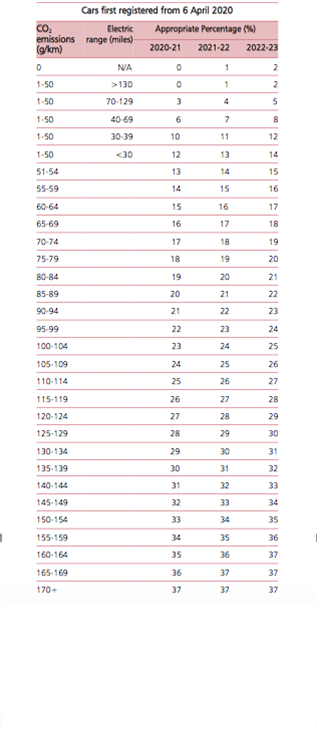

Because of this, the government has now announced that rates for cars registered from 6 April 2020 will start two percentage points below the previously announced 2020-21 rates in that year, then increase by 1% each year until they are level in 2022-23.

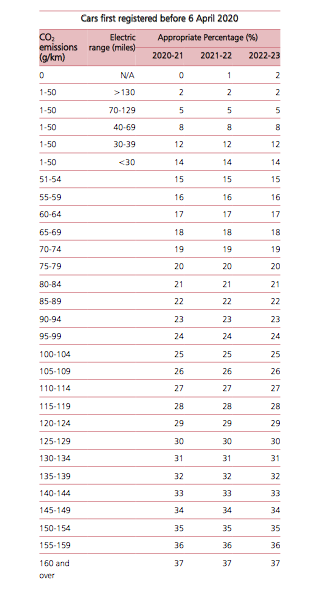

Cars registered before 6 April 2020 will be frozen at the previously announced rate for 2020-21 through the 2021-22 and 2022-23 tax years, with the exception of zero-emission cars, which will gradually increase from 0% to 2% whenever they are registered.

Reacting to the announcement, BVRLA director of policy and membership Jay Parmar said: "The government has responded positively to the company car tax campaign mounted earlier this year by the BVRLA, its members and fleet industry colleagues.

"Recognising the value of the company car market in supporting the transition to zero emission technology is also a positive endorsement for our sector, showing refreshing alignment between government's environmental and fiscal policies.

"The Treasury is giving back some of the unfair company car tax windfall it was set to receive as a result of WLTP and providing some essential extra visibility on future tax costs for those looking to order their next vehicle. This is a good day for company car drivers and our members."

Lex Autolease head of fleet consultancy Ashley Barnett said: "The lack of clarity on the long-term tax regime for company cars has severely hampered uptake, clearly reflected in the most recent car registration figures from the SMMT and the reduction in the number of people paying company car taxation.

"Today's announcement gives a degree of much-needed certainty to company car drivers and fleet managers.

"It is really good to see that BIK will be 0% on EVs from April 2020 with this increasing by 1% to reach 2% in 2022-23 regardless of registration date.

"The freeze on BIK for vehicles under NEDC-Correlated at 2020-21 levels for two years is also welcome news for the fleet industry. This, coupled with RDE2-compliant diesel vehicles being exempt from the 4% diesel supplement, gives clear foresight for company car fleet decision makers."